Company Overview

About Smart lend 3G

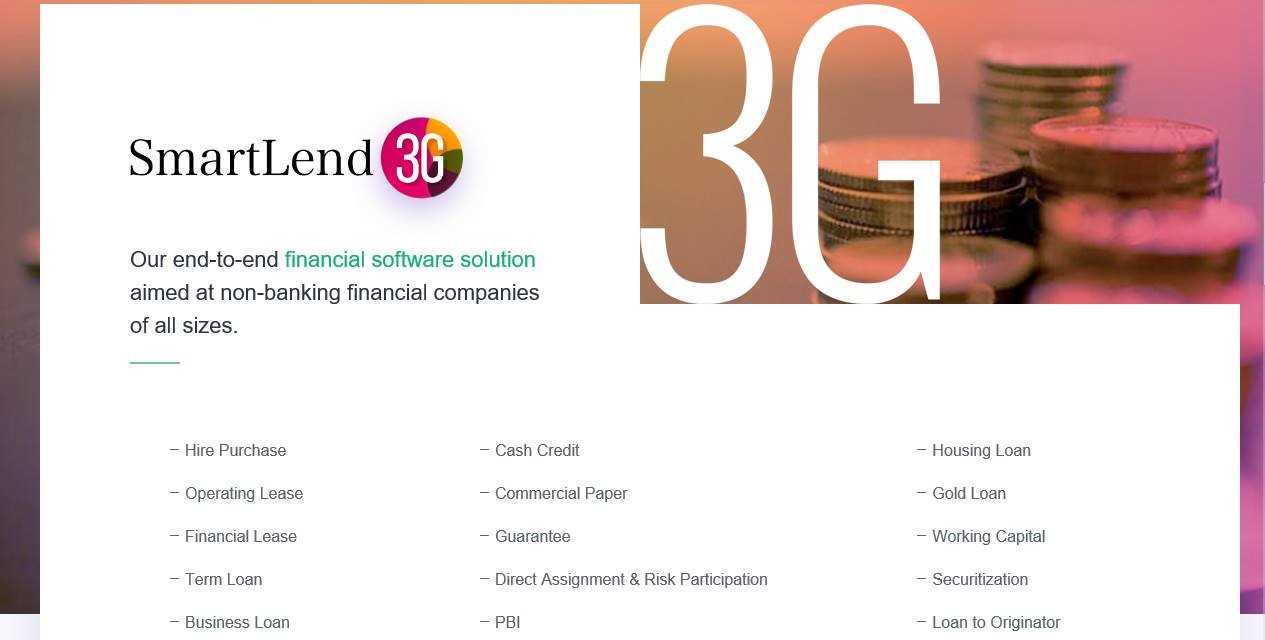

Smart lend 3G Details

What SIA Thinks

Smart Lend 3G is designed to simplify and streamline the loan management process for financial institutions. It’s a cloud-based software that allows lenders to manage their entire loan lifecycle from a single platform. Whether you are dealing with small personal loans or larger commercial loans, Smart Lend 3G ensures that all your operations can be handled more efficiently and with greater accuracy.

This software focuses on making your loan management tasks easier by offering features like automated workflows, comprehensive loan tracking, and detailed reporting. With Smart Lend 3G, you can effortlessly handle tasks such as application processing, credit checks, underwriting, and repayment tracking. It also includes user-friendly dashboards that give quick insights into your loan portfolio’s performance.

Smart Lend 3G also prioritizes security and compliance, so you can rest assured that your data is handled with the highest standards. Updates and maintenance are handled in the background, so you get the latest features without any downtime.

One of the standout features is its customization capability. It can be tailored to fit the specific needs of your lending business, whether you are a small firm or a large institution. This means the system will grow with you, adapting as your needs change over time.

Additionally, the software is accessible from any device with an internet connection, so you and your team can work from anywhere without missing a beat. This flexibility makes it especially useful for teams that are spread out or need to work remotely.

In summary, Smart Lend 3G is a versatile and user-friendly tool that helps lenders manage loans more effectively, saving time and reducing errors in the process. If you're looking for a reliable way to manage your loan portfolios, Smart Lend 3G might just be the solution you need.

Pros and Cons

Pros

- Cost effective

- Flexible terms

- Secure transactions

- Quick processing

- User-friendly interface

Cons

- High service fees

- Strict criteria

- Limited support

- No offline access

- Limited availability

Reviews

There are no reviews yet!!